Non-GMO market developments

After historical lows in 2020/21, the production of non-GMO soybeans in Brazil is recovering quickly. The projections for the next crop, which started in September, is to have an increase from 2.7 million tons (2021/22) to over 3.5 million tons, according to Instituto Soja Livre (ISL). The total national soybean crop (GM + non-GMO) is currently pegged at around 150 million tons, estimates for non-GMO certified beans correspond to nearly 2.5% of the total crop.

The figures refer to the production from farmers within the soybean origination inventory for the non-GMO crushers/exporters, which means traceable, certified beans, mostly destined for the European market. In Mato Grosso, the largest producing state, the non-GMO planted area is expected to increase 34.6% in 2022/23, from 365.2 to 491.6 thousand hectares. Mato Grosso yields roughly 50% of the national non-GMO crop. In Paraná, the non-GMO planted area should also increase, from 211.5 to 264.3 thousand hectares and in Goiás, from 64.6 thousand hectares to 85.3 thousand hectares.

Other sources in the market see further volumes coming from saved seeds, currently going under the radar, and additional quantities resulting from higher yields, compared to the national average, particularly in Mato Grosso. According to IMEA, average yields at non-GMO areas for the last crop cycle (2021/22), reached 65.5 (60kg) bags per hectare or near 4 tons/hectare, 6.2 bags/ha (0.77 tons/ha) higher than GMO seeds. The two combined factors may potentially add one million extra tons to the national non-GMO production, bringing the total to over 4 million tons. If last year’s great performance repeats in 2022/2023, Mato Grosso alone may produce almost 2 million tons of conventional soybeans.

The reasons behind such a vigorous recovery are many. First, non-GMO seeds available in the market are better adapted to regional soils and local climate conditions, presenting outstanding features and great performance compared to peer GM seeds. The latest non-GMO launches include short-cycle cultivars, resistance to rust and nematodes, and high-yielding varieties.

When considering returns, the bonus paid over non-GMO certified production reached an average of U$ 6.00 per (60kg) bag in Mato Grosso, or close to USD 100/ton, sometimes up to U$ 11 dollars per bag (U$ 180/ton). Under a scenario where production costs have raised more than 50% compared to last year, the non-GMO premium has become an extremely important factor influencing the farmers’ decision over seed technologies – GM seed costs increased nearly 68% in the state of Mato Grosso.

Usually, importers in the EU would be looking for spot opportunities outside their frame agreements, seeking lower costs over premiums. But the scenario is getting more complex this year.

The European scene

Since the start of the conflict in Eastern Europe, access to Ukrainian exports has been significantly impacted. Alternative ports, ground connections by road and rail, and all efforts have been employed to mitigate the effects of the war, but escalation is very much on the brink after Russia announced the new mobilization of reserve troops and threaten the use of heavier weaponry. Logistics solutions may suffer further disruptions.

The war is yielding yet another corrosive effect, the surge of energy prices, severely affecting industries in the EU, and oilseed processing plants among the casualties. The EU will consume 49.5 million tons of protein meal in 2023 (according to USDA, Sep. 2022), mainly rapeseed, sunflower and soybeans. Domestic crushing has been affected by energy prices, and considerable amounts of protein meals must be imported to balance the supply. To make things even more challenging, harsh weather conditions have hit crops across the entire continent. Soybean production in the EU is estimated to drop by more than 10%.

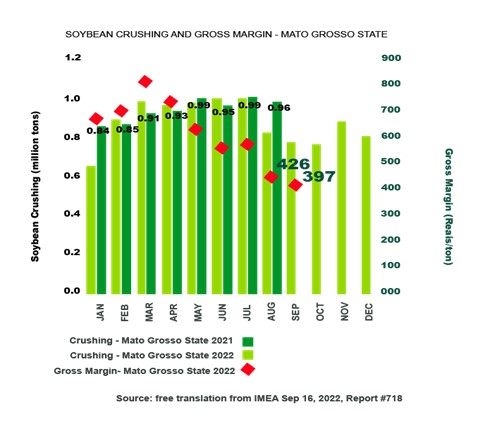

Brazil: crushing margins falling dramatically

According to IMEA’s report, from September 22, soybean crushing in the State of Mato Grosso grew 3.45% over the total processing from January to August, compared to last year’s. The volume reached a historic high, at 7.14 million tons. In August alone Mato Grosso processed 956.67 thousand tons, 19.49% higher than in August 2021. The exceptional demand for Brazilian soybean meal is already a result of skyrocketing energy prices squeezing margins for European crushers. The concerning factor is that since March, crushing margins in Brazil have dropped significantly as well. In the first two weeks of September, crushing margins in Mato Grosso have dropped 6.94% compared to last year.

The sector suffered another major blow at the beginning of the month. The government in Argentina started its new program to boost exports, introducing a new temporary exchange rate of 200 pesos/US dollar exclusively for soy exports (the regular rate is 137 pesos/US dollar). As a result, soybean sales boomed. From 268 thousand tons in the last week of August, farmers sold 2.1 million tons in the first week of September and 2.3 million tons from the 8th to the 14th. The outstanding offer of the product in the neighbouring country has had a devastating effect on the port premium in Brazil.

Non-GMO trade: a different game

Non-GMO trading, working fundamentally over frame agreements, is constructed on a different structure. Exporters in Brazil will fulfil their deliveries over the year no matter what happens in the market. Crushing plants processing non-GMO soybeans work on a very precise schedule, most of them 100% dedicated to the non-GMO industry. Brazil is probably going to yield at least one million extra tons compared to the volumes produced last year.

The prospect is for most of the Brazilian non-GMO production to be directed to processing, generating considerably increased volumes for non-GMO soybean meal compared to the last years. Prices, though, are a factor that might sour the taste of soybeans in 2023.

An interesting element is that non-GMO bonuses paid over the last years are much more attractive than the soybean dollar rate created to push sales in Argentina, or the losses in prices for Brazilian farmers linked to port premiums. Europe is the top and most solid buyer of Brazilian soybean meal, and the second importer of beans. Brazil is the largest and most reliable supplier of non-GMO soybean products outside Europe.

Collaboration needed

The next events rising on the horizon seem to be echoing that is more than time for Brazilians and Europeans to start cooperating more closely, an alliance that could be easily extended to Argentina and Paraguay, developing the non-GMO segment as a powerful buffer against the shocks in the market.