The 2023/24 non-GMO soybean crop in Brazil

Overview

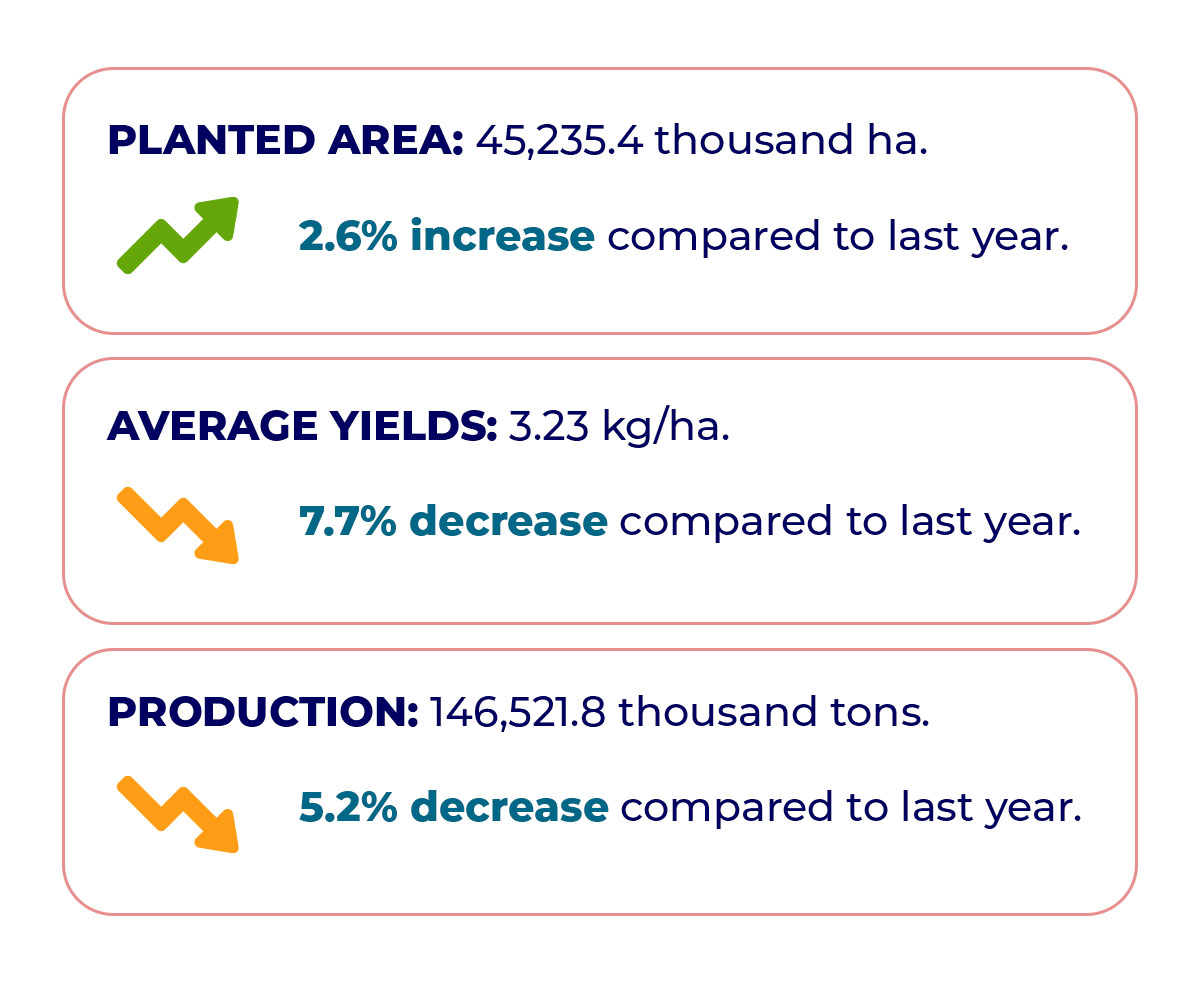

The 2023/24 harvesting works over soybean crops in Brazil are almost complete. In Mato Grosso, 97.8% of the areas are harvested. The pessimistic forecast for the bad weather damages is partially reversed, but significant losses are now undeniable. Yields have dropped almost 8% compared with last year. Uneven rains and extreme heat waves are the main drivers pushing yields down. In Paraná State, despite a major recovery in production compared to 2022/23, soybean fields endured intensive rain right after planting in November/December, and dry/hot weather along plant development in January and February. Yields in the state reduced by more than 17% compared to last season, to the current 3.1 tons/ha. Rio Grande do Sul, also seeing extensive improvement, beat Parana to the second rank in the national soybean scenario, similar results to what is observed in Argentina – current estimates peg the crop in the country somewhere between 49 and 50 million tons, compared with 20.5 million tons in 2022-23. As the total crushing soars to 40 million tons, the country repositions to the top in soybean meal exports (24 million mt), Brazil holding the second position (20-million-ton exports).

The non-GMO figures

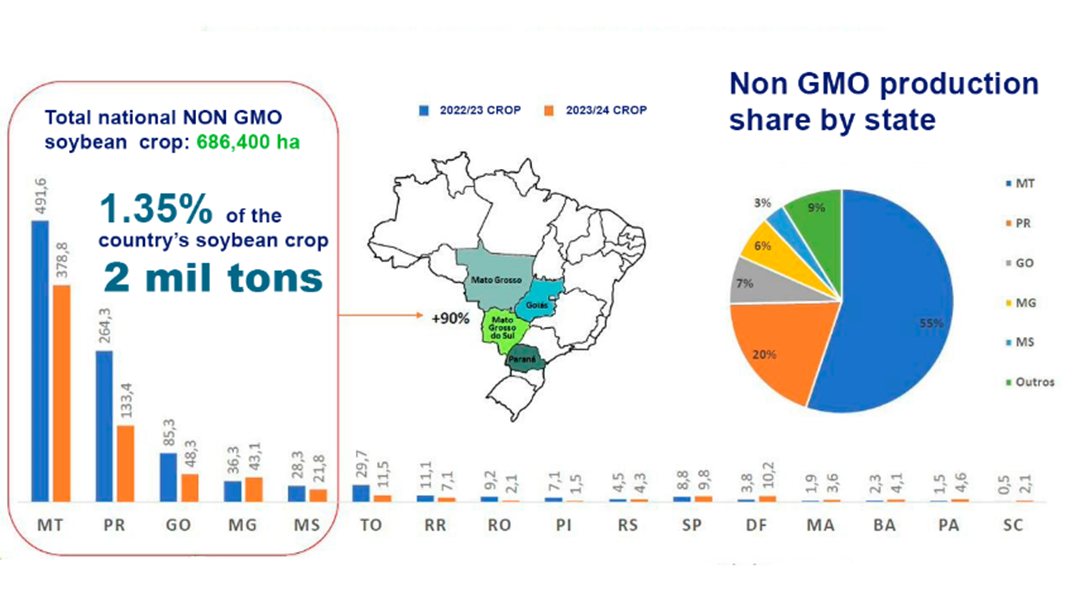

The weather issues affecting the whole Cerrado region have caused serious damage to the main national producer, Mato Grosso state. Also, falling soybean prices and still costly fertilizer inputs have influenced a reduction in the total planted area in the state, from 490 ha last season to the current 378.8 ha, a scenario resulting in a 1.2-million-ton crop in the state. At the national level, the planted area reached 686.4 hectares, figures that bring the national non-GMO soybean production to close to 2.0 million tons. Despite the increase in area compared to the last estimates, yields materialized lower, with climate factors weighing heavier than first considered.

The main concern is still the inconsistent demand from Europe, which has forced some farmers to sell their crops into the regular market, outside the sales under the non-GMO premium.

To make matters even more complex, the entire soybean supply chain in Brazil is engulfed in discussions around the implementation of the EUDR requirements, with substantial challenges for the logistics structure in the country. Exporters aiming at the EU market will have to introduce traceability and segregation protocols up and downstream to make sure that no products linked to deforestation are leaking into the corridors connecting Brazil to Europe. The soybean complex, by far the main export item leaving Brazilian ports towards the EU market, will undergo major efforts to adapt.

Considering that the soybean export logistic structure is already buried under the expressive growth seen in the last 4 years – an extra 23 million tons (beans + meal), the new requirements will add critical pressure over an already stressed system.

Soybean exports from Brazilian ports

| Destination | 2020 | 2021 | 2022 | 2023 |

| China | 60,595,851 | 60,476,502 | 53,682,583 | 74,471,944 |

| Asia (Except China) | 7,308,194 | 8,959,840 | 8,274,071 | 7,163,559 |

| EU 27 | 8,376,783 | 8,738,040 | 7,755,053 | 6,100,659 |

| Middle East | 1,235,263 | 1,943,660 | 3,086,125 | 3,138,033 |

| Other destinations | 5,457,333 | 5,989,551 | 6,050,597 | 10,995,695 |

| Total | 82,973,424 | 86,107,593 | 78,848,431 | 101,869,890 |

Soybean meal exports from Brazilian ports

| Destination | 2020 | 2021 | 2022 | 2023 |

| Asia | 7,513,978 | 7,946,735 | 9,862,048 | 10,233,904 |

| EU 27 | 8,345,610 | 7,952,515 | 8,948,713 | 10,283,068 |

| Middle East | 348,225 | 941,429 | 1,290,085 | 1,468,946 |

| Other destinations | 730,103 | 369,508 | 252,134 | 487,584 |

| Total | 16,937,917 | 17,210,187 | 20,352,980 | 22,473,503 |

Non-GMO industry – Proven traceability and segregation

For soybean exporters working under non-GMO certified standards, segregation, and traceability, including all sustainability requirements- represent a minor challenge. The Brazilian non-GMO supply has worked in compliance with all the requirements of the EUDR since the Soy Moratorium was agreed upon more than 17 years ago. However, the EUDR is affecting the whole logistic system in Brazil, segregation renewed needs weighing heavily over all warehousing and transportation facilities, from farms to ports, to include the whole volumes dedicated to the EU. The total EUDR impact on Brazilian logistics is still to be captured.

Positive changes in Brazil

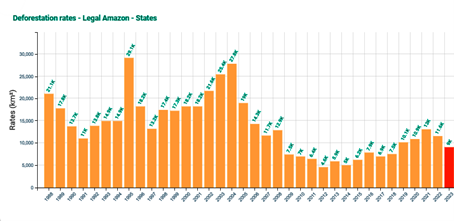

The new government brought significant shifts in environmental policies, ultimately causing deforestation in the Amazon area to drop 42% from January to July 2023, compared to the same period in 2022. There is still much to be done to reverse the damage done in recent years, but the scenario in the country is much more promising. If the whole year is considered (Aug 22 to Aug 23), the reduction reached 22.3%, according to the Brazilian satellite imaging program. Considering the whole mapped time frame, 2,593 km² of forests were spared. The state of Amazon is the one showing the highest reductions.

Conclusion

The shrinking non-GMO soybean volumes in Brazil spur great concerns. But the challenging times the industry is going through, including the CRISPR discussions on the European side, have also brought opportunities for the sector. Most of the non-GMO suppliers are already in compliance with EUDR’s requirements, which might convert into a privileged position towards importers from the EU. Second, the latest movements regarding ownership over non-GMO processing assets in Goiás and Parana might, very soon, bring a more solid capacity to the Brazilian supply of soybean products.

Finally, the ESG requirements present in most of the regulations coming into the EU (EUDR, CBAM, CSRD, CSDD), are producing real changes in the Brazilian agricultural landscape, an effect reinforced by the restructuring of federal laws under the country’s new administration. The non-GMO production, which has historically sought to comply fully with EU sustainability requirements, might represent a more attractive platform to buyers willing to import soybean products from Brazil.