Brazilian non-GMO soybean updates

Non-GMO Crop estimate

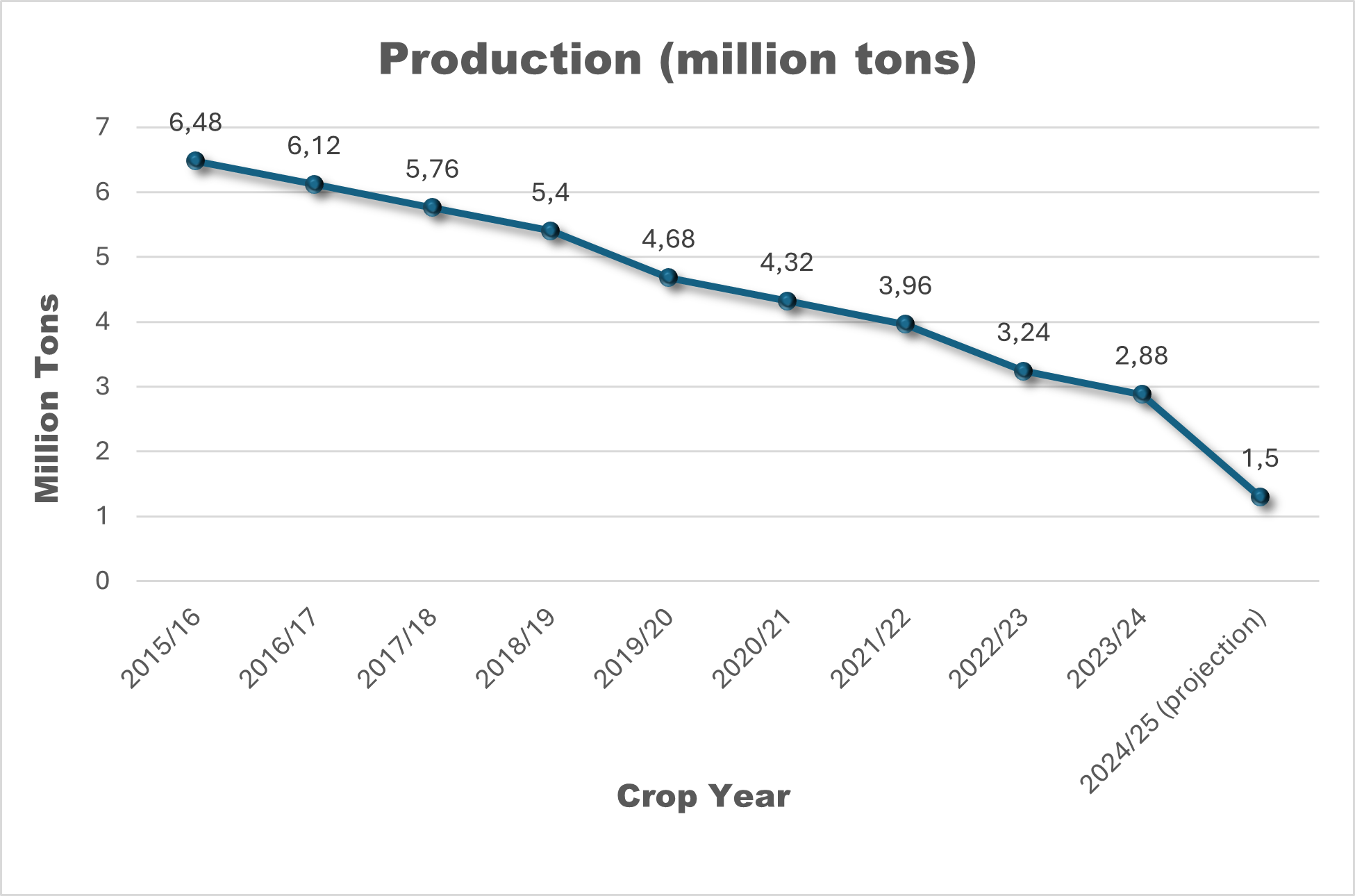

The 2024/25 non-GMO crop in Brazil is estimated to be close to 1.5 million tons, a historical low. Despite the significantly reduced volumes, this should be more than enough to cover current framework agreements, as demand from Brazilian farmers has also decreased.

The exceptionally low production is the result of an unfortunate combination of factors. First, the historical cycles of imbalance between demand and production (Brazil/Europe) have gradually eroded the confidence of Non-GMO farmers, driving them out of the market in addition, a series of recent unrelated events, such as commercial or legal -independent from the soybean market-, have affected crushers operating in Brazil, causing major processing plants to halt their production, and, consequently, slashing the demand for non-GMO beans from farmers.

However, as the premium paid over non-GMO certified exports has increased in line with the same course of negative trend, farmers have expressed a willingness to shift back to the production of non-GMO crops. This is particularly true in light of the recent fall in soybean prices in Chicago, a scenario that is likely to worsen given the extremely positive forecasts for the world soybean crop in 2025.

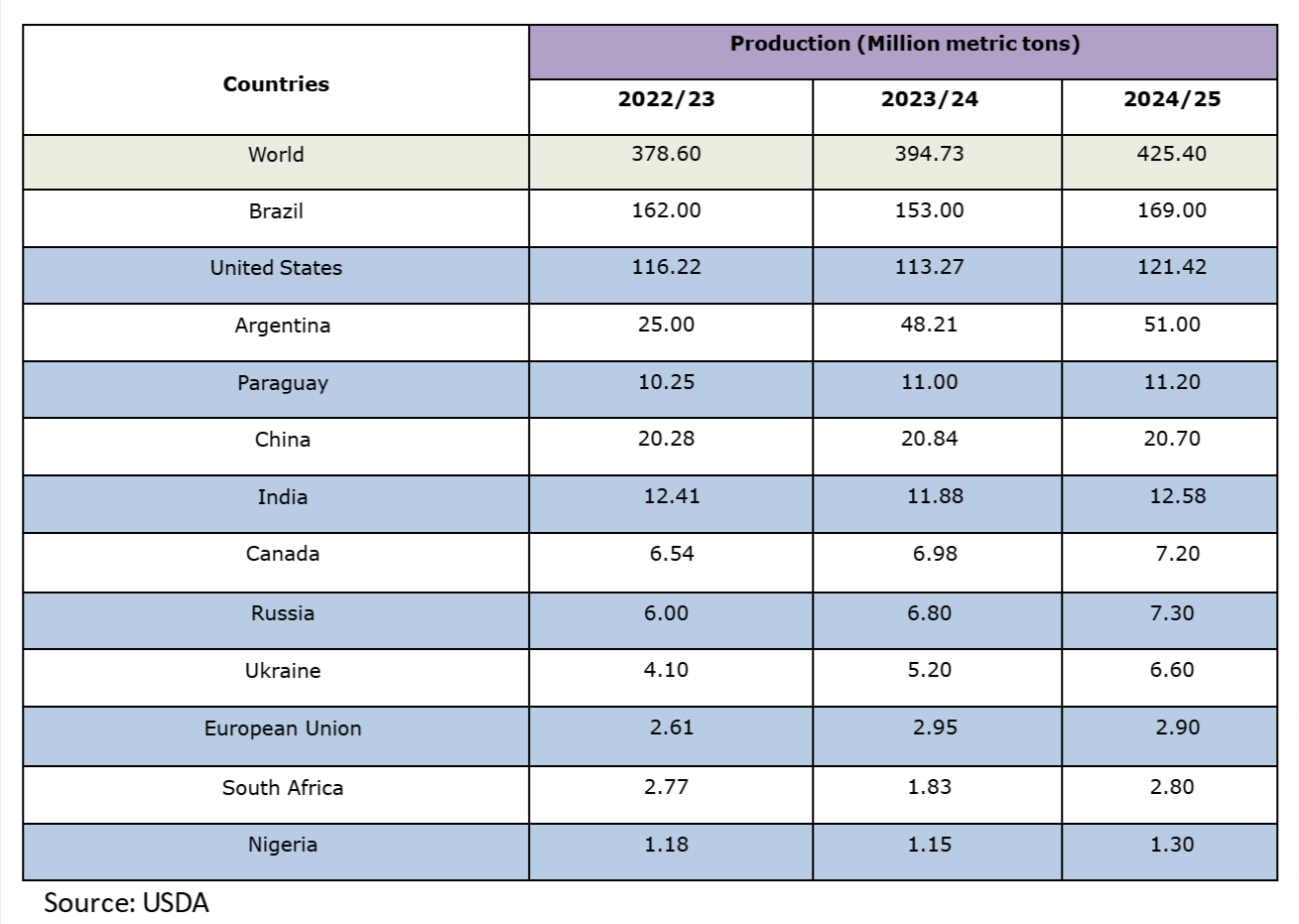

Increased Global Soybean Production

As margins collapse due to an oversupply of GM beans, the non-GMO premium becomes more important.

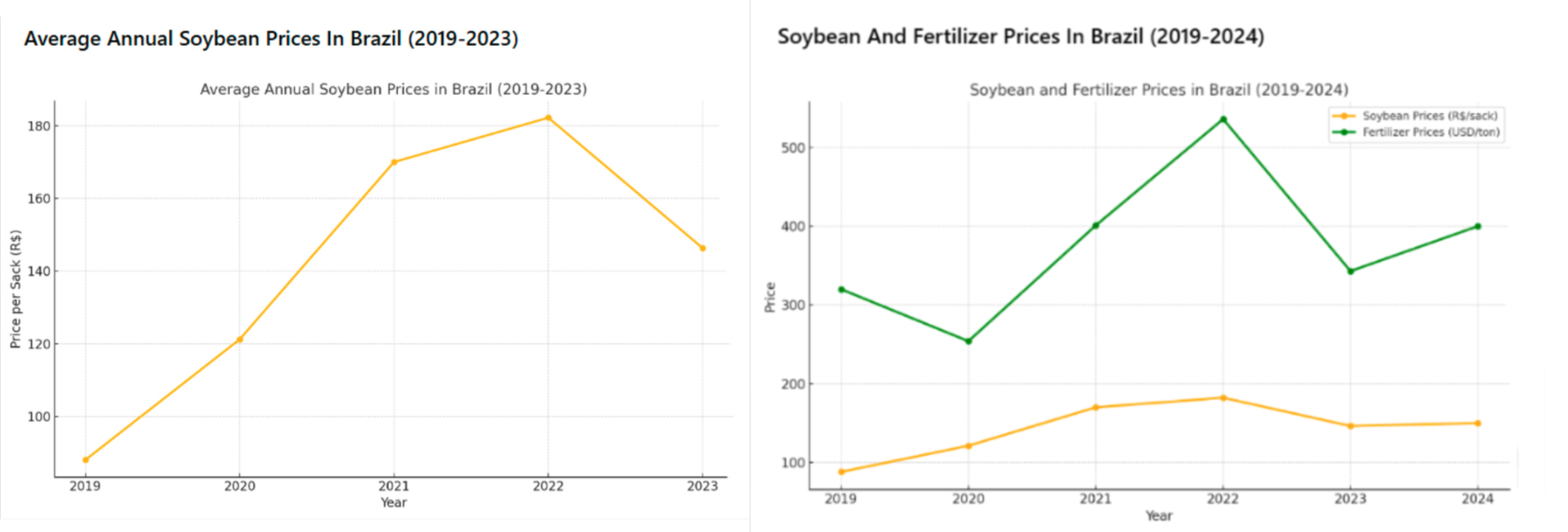

(GMO) Soybean prices escalated significantly from 2019 to 2023, mainly to climate related shortages in Argentina and South Brazil. Along the same period, the war in Europe, right after the COVID effects over worldwide logistics, influenced a stiff rise in fertilizer prices. After 2022, most commodities saw an adjustment in prices, moving back to levels prior to the inflationary years. However, fertilizer prices (and other farm inputs), regained momentum recently, while soybean prices have not followed an equivalent trajectory. As climate risks are still in the horizon, soybean prices saw recently a soft recovery but still not enough to offset the damaging impact of adamant high input prices.

Regenerative agriculture systems are also gaining popularity in Brazil, improving yields and reducing costs. Such farm management systems work much better without the chemical solutions, which are the basis for current GM technologies.

The main challenge now is that the recurring damage caused by a lack of long-term framework between EU importers and Brazilian exporters/farmers has more intensively affected the most important segment of the non-GMO supply: seed production.

Uncertainty about long-term prospects has driven away non-GMO seed developers and seed producers, given the high risks associated with market conditions potentially shifting dramatically by the time a new variety is launched—often years after the initial seed development process began.

Although farmers are currently keen to switch back to non-GMO production, the lack of seed has hampered a more substantial and rapid recovery in the non-GMO supply in 2025, when the crushers – currently operating at reduced capacity – are expected to resume full production.

The EUDR – Impact of the approved delay on the Brazilian soybean market

The European Deforestation Regulation (EUDR) provoked mixed feelings among producers and exporters in Brazil. Many Brazilian farmers, who maintain protected forests on their private land in accordance with local regulations, perceived the EUDR as a violation of their rights to private property, particularly those who have maintained portions of protected areas beyond the local legal requirements.

The Brazilian Forest Code allows for limited deforestation up to a certain limit. Landowners are required to maintain a portion of their property covered with native vegetation, depending on which biome the area is located:

- 80% preservation within the Amazon biome.

- 35% in the Cerrado biome (within the Legal Amazon region).

- 20% in other regions and biomes.

Brazil counts on natural resources to make low-carbon agriculture possible. More than 60% of the country´s territory remains covered by native forests, the second largest natural forest in the world and by far the most diverse. The rate of deforestation in the Amazon has been reduced by 47% under the new government, the highest reduction in 15 years. Nearly 90% of the country´s electricity matrix is renewable.

At a time when the current Federal Administration in Brazil is struggling to resist anti-progressive forces, rebuild environmental agendas and advance efforts towards an EU-Mercosur agreement, cooperation is crucial, and at a time when the EU is also seeing the rise of dangerous conservative political forces.

Brazil and the EU are complementary economies and historical partners, and it is only through real cooperation and open dialogue that this partnership can thrive. The non-GMO segment is the perfect channel to bridge the gap between Europeans and South Americans. It is time to engage and foster cooperation.