Estimated Brazilian non-GMO soybean crop in 2025

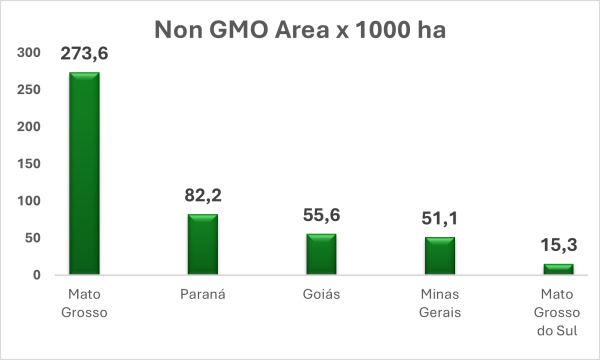

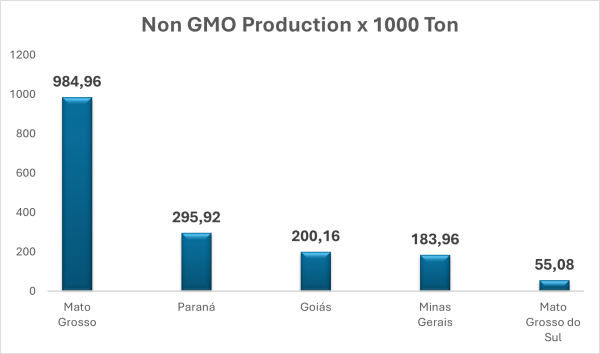

The SOJA LIVRE INSTITUTE has just published its projections for the new crop. Based on farmers’ purchases of non-GMO seed and reports from members of the crushing industry, the figures put the current national non-GMO area at less than 500 thousand hectares.

Mato Grosso is still the main supplier, with more than 50% of the area.

Despite the drought in the southern states, particularly in Paraná and Rio Grande do Sul, national soybean production will reach a new record in 2025; CONAB (The National Supply Agency) estimates it at 167 million tonnes, and the USDA at 169 million tonnes. These estimates are at least 20 million tonnes higher than last year’s harvest.

Nevertheless, non-GMO production in Brazil remains limited to the same factors presented at the end of 2024.

From this perspective, although the total production forecast by SOJA LIVRE remains close to the 1.7 million tonnes estimated earlier, most of the farmers producing non-GMO crops are now under the radar. They are primarily driven by local agronomic factors, such as seed performance, pricing, climate adaptation, and weed resistance, rather than by the market premium.

As dedicated crushing production has been severely reduced due to a thinning demand, the volume of certified products for the European market has decreased proportionately and is currently below one million tonnes (SPC, hipro meal, soybeans) in soybean equivalent. The remaining beans produced from non-GMO seeds are being sold on the domestic market as standard GM beans without a controlled origin or premium.

The current demand, with such reduced volumes, may influence the maintenance of all the logistics, seed development, certification and traceability efforts that have ensured the Brazilian supply of non-GMO to Europe and the world meeting high standards, preserving traceability, free from deforestation, cross-contamination, and many of the risks common to the market operating outside controlled origins.

The non-GMO supply chain and the upcoming sustainability demands

Over decades of development, stakeholders across the non-GMO supply chain from Brazil to Europe have played a crucial role in establishing a highly efficient export corridor. This network relies on dedicated inland infrastructure, including elevators and transshipment terminals, as well as overseas logistics such as port terminals and storage facilities. Advanced certified traceability systems, using satellite imagery, inspections, and audits, ensure transparency. Meanwhile, alternative farming practices that minimise chemical inputs enhance sustainability. These long-term efforts are now adding significant added value to non-GMO production in Brazil. As global concern about climate change grows, issues such as deforestation and carbon emissions have taken centre stage. Non-GMO farming, which reduces reliance on glyphosate-based management, has been shown to be less disruptive to soil microbial communities. These microbes are essential for improving plant nutrient absorption and play a key role in greenhouse gas mitigation by sequestering nitrogen and carbon in the soil. By optimising nutrient availability to plants, non-GMO farming reduces reliance on synthetic fertilisers (NPK), which are predominantly fossil-based and require long, fuel-intensive transport to Brazilian farms. This shift significantly reduces CO₂ emissions while promoting a more sustainable agricultural model.

Significantly, the majority of soybean transactions in Brazil still take place through non-traced corridors, where soybeans of different origins and qualities are mixed in silos and transportation units. As Brazil’s soybean cultivation continues to expand rapidly each year, non-dedicated logistics facilities are managing increasingly diverse and larger volumes with each crop cycle. This growing complexity further complicates efforts to ensure traceability and maintain quality control across the ordinary soybean supply chain.

The high standards maintained within the Brazilian non-GMO chain will become even more important in light of the upcoming international regulations, particularly for companies sourcing Brazilian soy.

Against this backdrop, the coming year will be challenging for those expecting leniency in ESG approaches. Instead, stricter global regulatory and disclosure requirements, particularly in Europe, are coming into force, even under some recent political uncertainty in the EU community. Despite these challenges, multinational companies are unlikely to retreat from their sustainability commitments as stakeholders, including shareholders, investors, customers, and employees, continue to demand responsible business practices. The Soybean Moratorium, for example, is secured under the non-GMO certified chain. NGOs remain poised to hold companies accountable, either by reinforcing existing commitments or advocating for change through legal action.

The support of European stakeholders and the entire supply chain, including food retailers and protein producers with strong ties to Brazilian soybean growers, is particularly critical to guarantee sustainable and continuous supply in the future.