Non-GMO soybean harvest forecasts 2023/24

Financial challenges

The year 2023 has brought unexpected figures for the non-GMO sector, especially overseas. Firstly, the purchase of seeds and other inputs has been delayed compared to other seasons, affecting all soybean producers but with a particular impact on non-GMO production. reason behind the lingering is the uncertainty caused by falling soybean prices and the bottlenecks in logistics. Under a record corn crop, which comes right after the soybean harvest, the logistics structure has suffered extraordinary pressure. As the corn harvest flows from the production areas to the ports, fertilisers, and other inputs travel in the opposite direction, creating fierce competition for transportation assets.

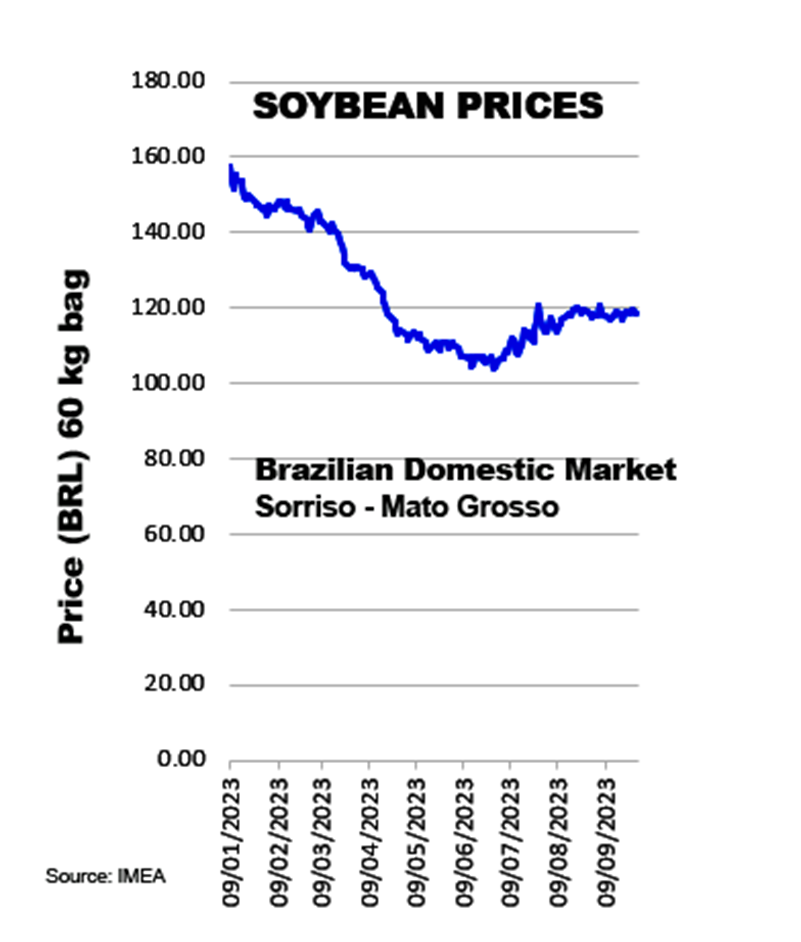

On the financial front, although most input costs have fallen significantly over the last three months, local soybean prices fell sharply from March to June, reducing farmers´ purchasing power. For the first time in years, soybean production in Brazil will barely reach break-even. The continuous fall in fertiliser costs, however, has encouraged farmers to wait an unusually long time for a recovery in future soybean prices. Although risky, this strategy has recently paid off, with local prices rising and fertiliser prices still falling.

Weather-tight grip

Pro Farmer, a division of Farm Journal Media, forecasts a smaller US soybean crop than the latest USDA report, due to weather concerns. Weather conditions show half the average rainfall in MY 2023/24, particularly over the Midwest. The US soybean output is expected to decrease by 2% to 4% compared to 2022, as a result of lower acreage and yields. This scenario has pushed Chicago prices up, and Brazilian prices are following the bullish outlook.

As September approaches, farmers in the Brazilian Cerrado are preparing for pre-planting crop management, and early El Niño rains can be seen across the country. The warmer weather reduces the risk of winter frosts and secures shorter cycles. The favourable scenario indulges farmers to cling to their waiting strategy, and the decision on whether to purchase GM or non-GMO seeds has never been so delayed. Farmers enter September under a benign weather scenario, but October could see the negative effects of the onset of El Niño, with scarcer rainfall and warmer temperatures, particularly over areas closer to the north.

The non-GMO perspective

For non-GMO farmers, costs have been an additional positive factor. Seed costs have fallen over the past three months, while GMO seed prices have risen.

Another relevant factor, and unprecedented in the history of GMO mainstreaming, is that the non-GMO yields have reached higher average levels than their GMO peers this season in Brazil. As the non-GMO market has shrunk over the years, farmers who have remained in the production have become more and more specialised, while GMO producers – more than 98% of the national soybean crop, have ranged from very poor performance to record yields. In addition, non-GMO varieties that were developed over the last decade have finally reached the market in the last two crops, contributing to the fact that the average non-GMO soybean yields are now higher than those of GMO crops.

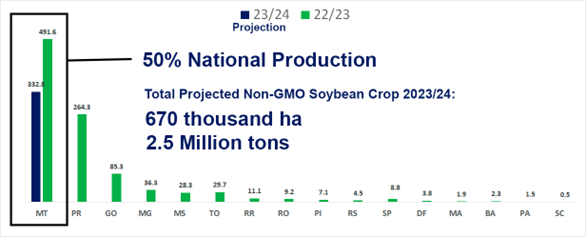

In the current economic scenario, Brazilian non-GMO farmers are waiting until the last minute to decide whether to stay in non-GMO production, buy conventional seeds, or switch to the less profitable/risky GM commodities market. In such an uncertain scenario, projections of non-GMO production for the next crop (2023/24 cycle) have changed again, still lower than in 2022/23, but increasing compared to the latest surveys. Brazilian production of segregated non-GMO beans is expected to reach almost 3 million tons, enough to supply all current export programmes to Europe in 2024.

Current forecasts (October) from seed producers in Mato Grosso show an increase of almost 20% over the last estimate in September. Recent seed purchases now indicate a planted area of 400 thousand hectares, which should yield close to 2.9 million tons of soybeans. The next crop report by IMEA should revise the figures and reflect the latest expansion of the planted areas.

Soybean Production Costs in Mato Grosso – 2023/24 crop: GMO vs non-GMO

| TECHNOLOGY | NON GMO | GMO | ||||||

| Crop Year | 2023/24 | 2023/24 | ||||||

| Calendar Year | 2023 | 2023 | ||||||

| Month Considered | July | Aug | Sep | July | Aug | Sep | ||

| A. OPERATING COSTS (1 to 6) | 3745.44 | 3804.87 | 3793.02 | 3,781.91 | 3,775.92 | 3,783.14 | ||

| 1. SEEDS | 632.62 | 630.15 | 629.04 | 703.57 | 662.49 | 652.47 | ||

| Soybean Seeds | 545.22 | 528.84 | 542.94 | 648.38 | 603.39 | 594.45 | ||

| Cover Seeds | 87.40 | 101.30 | 86.09 | 55.19 | 59.11 | 58.02 | ||

| 2. FERTILIZERS & LIMING | 1,367.35 | 1,436.65 | 1,395.72 | 1,563.80 | 1,621.30 | 1,612.41 | ||

| Soil Liming | 116.16 | 118.32 | 113.27 | 139.75 | 145.86 | 141.23 | ||

| Macronutrients | 1,209.72 | 1,274.45 | 1,237.60 | 1,306.15 | 1,354.27 | 1,350.29 | ||

| Micronutrients | 41.47 | 43.88 | 44.85 | 117.90 | 121.17 | 120.88 | ||

| 3. CHEMICALS | 1,462.04 | 1,434.15 | 1,450.06 | 1,205.27 | 1,161.84 | 1,172.38 | ||

| Fungicide | 426.42 | 412.49 | 434.77 | 368.07 | 356.86 | 373.99 | ||

| Herbicide | 312.56 | 313.09 | 307.02 | 249.57 | 234.87 | 233.24 | ||

| Insecticide | 644.60 | 630.04 | 629.67 | 476.28 | 458.87 | 454.09 | ||

| Other | 78.46 | 78.53 | 78.60 | 111.35 | 111.23 | 111.06 | ||

| 4. CUSTOM OPERATIONS | 142.83 | 163.32 | 177.59 | 145.06 | 182.98 | 166.91 | ||

| Crop Management before Planting | 14.79 | 16.91 | 18.38 | 16.05 | 20.25 | 18.51 | ||

| Fertilization & Seeding | 39.70 | 45.39 | 49.39 | 41.40 | 52.07 | 47.65 | ||

| Machinery Operation | 39.27 | 44.90 | 48.77 | 28.81 | 36.35 | 33.15 | ||

| Harvesting | 49.07 | 56.12 | 49.77 | 58.78 | 67.57 | 74.29 | ||

| Crop Management after Planting | – | – | – | 0.03 | 0.03 | 0.03 | ||

| 5. OUTSOURCED SERVICES | – | – | – | 14.25 | 13.58 | 13.16 | ||

| Outsourcing | – | – | – | 14.25 | 13.58 | 13.16 | ||

| 6. LABOR | 140.61 | 140.61 | 140.61 | 149.96 | 149.80 | 149.74 | ||

| Hired Labor | 122.45 | 122.45 | 122.45 | 135.31 | 135.14 | 135.08 | ||

| Temporary Labor | 18.15 | 18.15 | 18.15 | 14.66 | 14.66 | 14.66 | ||

| Yields (bags/ha) | 61.34 | 61.34 | 61.34 | 59.74 | 59.74 | 59.74 | ||

| Dolar Rate (R$/US$) | 4.8002 | 4.9029 | 4.9364 | 4.8002 | 4.9029 | 4.9364 |

Source: IMEA

The chart below shows the average annual production costs of GMO and non-GMO crops since 2020. In 2023, GM crops became more expensive, reversing a historical trend.

| Year Average | Year Average | Year Average | Average to June | Average to July | |

| Calendar Year | 2020 | 2021 | 2022 | 2023 | 2023 |

| GMO | |||||

| Operational Costs | 2,391.26 | 2,936.56 | 4,910.24 | 4,236.90 | 4,178.79 |

| NON-GMO | |||||

| Operational Costs | 2,463.38 | 3,111.93 | 5,107.91 | 4,234.47 | 4,168.98 |

| Difference | 72.12 | 175.37 | 197.67 | -2.44 | -9.81 |

Source: IMEA

The moment calls for intensive cooperation amongst all non-GMO producers. The Brazilian case may help demonstrate that GMOs, contrary to all promises, have not brought any increase in yield or reduction in costs. However, the threat of resistant weeds is very real, as is the need for higher use of chemicals. Most importantly, labelling has never stopped the development of GMO seeds, which currently have a 98% market share.

On the EU side, retailers and animal protein producers must start discussions to strengthen their traceability systems to prevent sourcing from origins where health and environmental controls do not follow strict regulations.