The 2024 non-GMO soybean crop in Brazil: unforeseen factors impacting the production

Figures for the 2024 harvest point to approximately 1.5 million tons of non-GMO soybean exports, a significant reduction compared to last year. Some unexpected events in Brazil led to substantial changes in demand and consequently affected production. The first negative factor was the interruption of the crushing activities at IMCOPA’s plant in Araucaria, Paraná, one of the country’s largest processing plants for non-GMO soybean meal and SPC.

The second factor is that major European buyers of non-GMO soybeans in Brazil stopped purchases in 2023, most likely due to the difficulties imposed by the war-related political embargoes.

The combined effect of these two events was to end demand for non-GMO beans in the south, particularly affecting the production in Paraná, historically the second largest producer of non-GMO beans in the country.

Thirdly, company acquisitions and delays in purchasing non-GMO beans from farmers within traditional non-GMO areas created significant uncertainty among farmers about the future of non-GMO production in Brazil.

All of these movements have also affected the purchasing pace at the European end, with players awaiting a clearer definition of the Brazilian crushing capacity following the reorganisation of critical assets in the local non-GMO supply chain. The sequence of negative events that began over a year ago has caused a major disruption in the demand for Brazilian exporters, which is now beginning to recover, influencing an escalation in non-GMO premiums to currently over USD 200.00 per ton.

Nevertheless, the uncertain scenario drove farmers away from non-GMO production, damaging seed multipliers and seed producers, who had planted under a different perspective, expecting higher seed sales. Losses reached USD 10 million for the largest seed producers in the Cerrado area, who were forced to sell the seed as beans.

The lack of communication has once again damaged the entire sector and caused unnecessary disruption to the supply chain.

Promising prospects

On the other hand, if the current situation raises concerns about the availability of volumes, positive and important factors can influence major changes in non-GMO production and supply.

The first is the impact of EUDR’s on Brazilian logistics. While the non-certified supply hassles over constrained logistics and uncertain production, the non-GMO certified supply has organised segregated traceable logistics since the Soybean Moratorium back in 2008. Companies specialising in the production of non-GMO soybean products such as Caramuru, Amaggi and Bunge/Selecta have built solid export corridors through fully verticalised logistics, providing certified traceable deforestation-free flows to Europe. Such configuration secures risk-free supplies that are currently operating below their full capacity and ready to expand. Even if the deforestation penalties become more flexible,, an unlikely scenario, non-GMO suppliers are prepared to offer this as an advantage by providing deforestation-free exports regardless of what the regulation says – a distinct advantage given the extreme climate events around the world.

The second major factor is the arrival of new high-performing non-GMO seeds. Seed developers such as Embrapa, TMG, Braveza and UFV have delivered competitive varieties to farmers. Although their performance makes them competitive even outside the non-GMO market premium, segregation and certification only make sense if there is a buyer.

The third factor is the falling price of soybeans. In 2020, the price of a 60 kg bag was close to USD 16.00 on the domestic market. Prices went up to close to USD 30.00 per 60 kg bag in 2022, also driven by the steep increase in the cost of synthetic fertiliser due to the war in Ukraine and the cost of chemical inputs as a result of the COVID-19 impact in manufacturing of such products. Currently, prices dropped back to close to USD 20.00 per 60 kg bag. Although production costs have seen some reduction, soybean farmers are now experiencing very thin margins. In this context, any premium paid over non-GMO soybeans now represents a significant profit compared to the regular non-traced market.

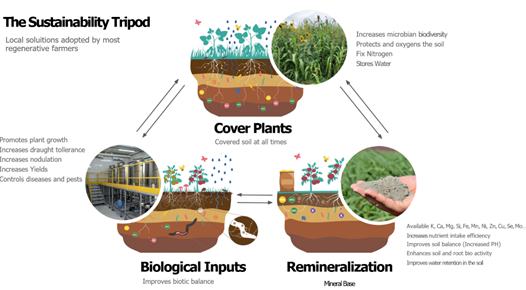

Fourthly, significant data confirm that non-GMO soybean crops under Regenerative Tropical Agriculture have higher sustainability indicators than their GMO equivalents. Longer periods of available sunlight, soil-plant microbial interactions favoured by warmer temperatures, and intensive use of non-tillage techniques are some of the factors, in addition to the fact that the main production areas (South, Southeast and the Southern parts of the Center West regions) are far away from the Amazon Biomes and from deforestation areas.

Data from GAAS (The Group of Associated Sustainable Farmers) shows that non-GMO beans planted under regenerative farming management using rock weathering, no-till, microbial inoculation, and cover crops significantly reduce the need for synthetic/chemical inputs and increase yields

Applied over more than 3.5 million hectares in the country, over different application intensity levels, sustainable agriculture practices have produced results such as an average of 60 to 80% reduction in the use of chemical/synthetic inputs, and a 30% reduction in input costs. Sustainable agriculture techniques eliminate the need for herbicides or any GM technology. Without herbicides, field studies have shown excellent root development and nodule formation under nitrogen-fixing bacteria in soybean crops. The carbon balance resulting from the application of such a model is the most effective when most of the fossil elements and their emissions are removed from the equation.

There is a large window of opportunity to promote non-GM crop management techniques, based on the economic and environmental impacts for farmers. However, the demand is the critical element in the transition to sustainable, low carbon, GMO-free agriculture.

Improved communication between end consumers in Europe and farmers, exporters and government agencies in Brazil is needed to advance the non-GMO production and guarantee long-term production.

The Non-GMO Summit, taking place in Frankfurt on 7-8 October, will play a key role in providing insights into non-GMO production, from regulatory updates to market trends. It will also explore the impact of new GMOs or New Genomic Techniques (NGTs) on non-GMO value chains, focusing on the EU regulatory framework and strategies to ensure non-GMO innovation.