The non-GM production: how volatility is killing the supply chain in Brazil

Genetically Modified Organisms (GMOs) entered the Brazilian market in 2003[1]. By then, 30% of the Brazilian soybean production, concentrated in the southern states of the country, was already using GM seeds, which were illegally acquired across the border in Argentina[2].

In March 2005, the federal government approved the Biosafety Law (no. 11.105)[3] which allowed the commercialization of GM RR (Roundup Ready) soybeans (resistant to glyphosate herbicide) and a decision had to be made: either reinforce the regulations in place and rule the destruction of the illegal GM crops in the country, or pass new regulations that could legitimate them for commercialization. At the state level, the governor of Paraná felt compelled to cancel the prohibition of growing, selling, and transportation of GMOs through the state, leading to a strong expansion of GM seed usage in Brazil and trade, specially through Paranaguá port (in Paraná), which was strategic for soybeans export coming from all over the country, especially from Mato Grosso.

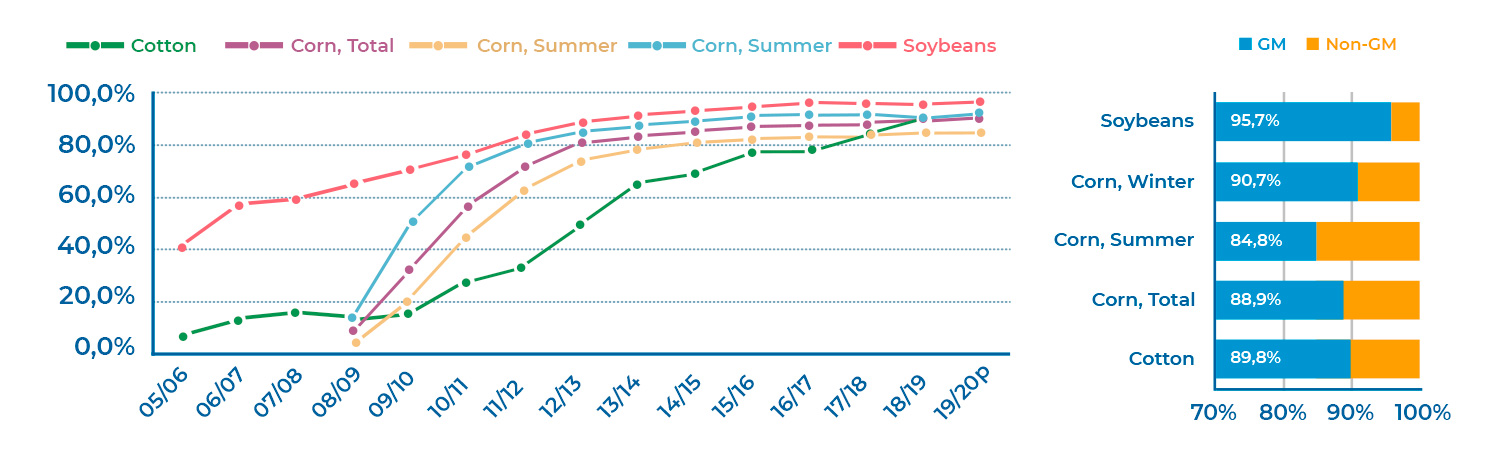

The graph below shows the development of GMO crops in Brazil, from 2005 onwards:

Source: Celeres, November 13, 2019 (p: projection)

Available at: http://www.celeres.com.br/wp-content/uploads/2019/11/BoletimBiotecnologiaCéleres_Novembro2019-2.pdf

Premium Fluctuation

After the introduction of the GM RR technology, seed companies started to charge over the use of a cultivar, exerting control over farmers, who could no longer multiply seeds without paying royalties, technology or compensation fees.[1]

GM plants were promised to require a reduced number of sprays, less use of machinery, fuel and labour. However, many of these claims weren’t accomplished in the past decades.

Non-GM seed breeders invest many years in new cultivars. It is a long-term commitment involving investments in R&D, machinery and IP programs, besides the higher costs of crop management which demand strict control and application of methods.

Non-GMO farmers, to avoid the increased risk of contamination all over the whole supply chain, had to consolidate inside a financially feasible logistics perimeter, areas only dedicated to the non-GM market – predominantly the exports to non-GM Europe. If there is no concrete compensation, in terms of raising the premium, farmers easily change to the GMO approach, sell their equipment and start buying inputs into the GMO crop management supply. The main difference between buyers, farmers and seed developers relates to time: buyers work on maximum one year long premium agreements, farmers need at least twice as much time in advance to produce the demanded volumes and seed developers must have a minimum of three years ahead to supply farmers with the required seed quantities. This imbalance has further deepened the price fluctuation strategy.

Where we are today

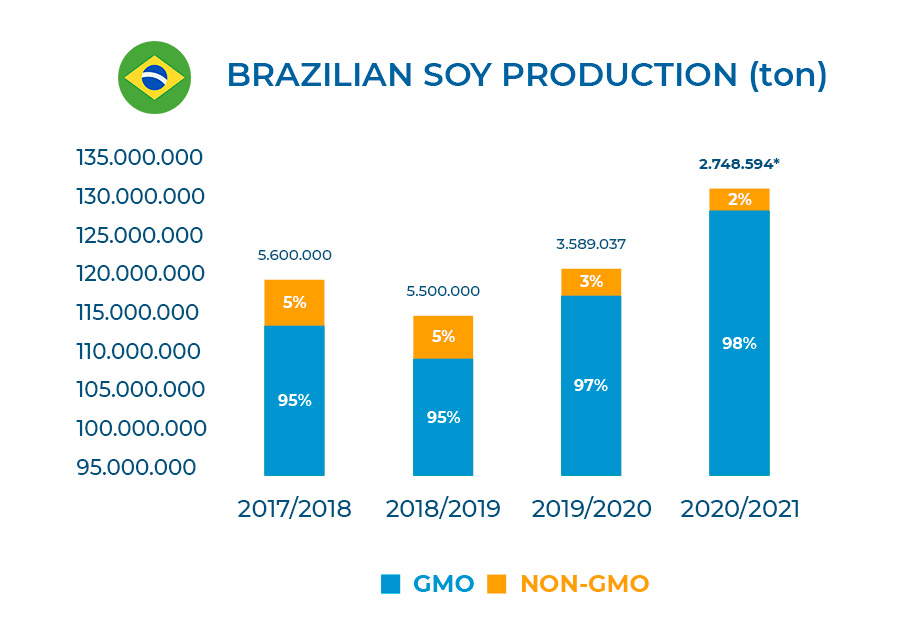

In the last webinar session[2] organized by ProTerra Foundation, held on September 30th, our guest speaker, Patricia Campos, Sustainability manager at CJ Selecta[3], showed the decrease of non-GM production in Brazil in the recent years. Looking at the table and graph below, which describes the Brazilian soy production numbers, we can notice the rapid reduction of non-GM production in the recent years. The main causes include the lack of incentives to farmers, commercially speaking: the non-GM premium prices were not attractive enough. To overcome this issue, CJ Selecta has implemented the Seed Program, aimed to encourage farmers to plant non-GM seeds.

Source: CONAB, September, 2020

For instance, the state of Mato Grosso, the main soybean producer in the country, has reached in 2019/2020 a historic low production of non-GM soybeans, equivalent to 5% of the total soybean production in the state. One of the main reasons behind this is the high fluctuation of the premium paid over certified non-GM products.

Given these astonishing numbers, it is our duty at the ProTerra Foundation to keep the positive agenda moving forward. We are committed to the protection of biodiversity, full transparency and traceability, promote and ensure that sustainably produced non-GMO food and feed products are independently certified and available on the market.